Millions of Americans Have Discovered a Way to Become 100% DEBT-FREE in Just 12-36 Months

Without Loans, Hidden Fees, or Bankruptcy! Could You Be Next?

- Erase up to 50% of your total debt, all at once

- Become 100% DEBT-FREE in 36 months or less

- Switch to one manageable monthly payment

-

Restore your credit score in the process

To get started, select your debt amount:

This won't affect your Credit Score

CUSTOM JAVASCRIPT / HTML

Millions of Americans Have Discovered a Way to Become 100% DEBT-FREE in Just 12-36 Months

Without Loans, Hidden Fees, or Bankruptcy! Could You Be Next?

If you qualify, this program could help you:

- Erase up to 50% of your total debt, all at once

- Become 100% DEBT-FREE in 36 months or less

- Switch to one manageable monthly payment

-

Restore your credit score in the process

Take this 1-minute quiz to find out if you qualify!

To get started, select your debt amount:

This won't affect your Credit Score

Will I Be Qualified for the Program?

You have over $10,000 in debt

This is the baseline for us to negotiate on your behalf; it gives us greater leverage and a better chance at settling debts with your creditors.

You are able to make monthly payments

To qualify for debt relief, you’ll need to be prepared to make a manageable monthly payment. We’ll work with you to agree on an amount that’s realistic for you and your family. If you can manage this, you’re likely

to be instantly qualified.

You have unsecured debt

We only work with unsecured debts, debts that do not have collateral attached to them. Credit cards, medical bills and payday loans are all examples of unsecured debt. Debts like student loans and those that do have collateral attached to them like mortgages and car loans are not eligible for debt settlement.

Ready to find out for sure? It’s free, takes just 1 minute, and won’t affect your credit score:

Ready to find out for sure? It’s free, takes just 1 minute, and won’t affect your credit score:

Your Debt-Free Life is Finally Within Reach!

Step 1

Step 1

Get your FREE Debt Relief Roadmap

Free Consultation

Meet with a friendly Debt Relief Expert who will listen to your story, answer your questions, and create a personalized Debt Relief Roadmap, just for you. You’ll walk away with the clarity and confidence to move forward in a direction that’s right for you.

Step 2

Step 2

Erase up to 50% of Your Total Debt

Consider Your Options

An experienced debt relief attorney will carefully review your situation and notify your creditors that you’re now officially represented (they’ll stop contacting you). Then we’ll work directly with your creditors to wipe out 20%-50% of your total unsecured debt, all at once.

Step 3

Step 3

Get To Work

Make ONE manageable monthly payment to demolish your debt in 36 months or less—while improving your credit score in the process! Throughout your journey, you’ll work with a dedicated account manager and get regular updates via email, phone, and text.

Your debt-free life is finally within reach!

Here’s how to get there—in 3 simple steps:

Step 1

Free Consultation

Get your FREE Debt Relief Roadmap

Meet with a friendly Debt Relief Expert who will listen to your story, answer your questions, and create a personalized Debt Relief Roadmap, just for you. You’ll walk away with the clarity and confidence to move forward in a direction that’s right for you.

Step 2

Consider Your Options

Erase up to 50% of Your Total Debt

An experienced debt relief attorney will carefully review your situation and notify your creditors that you’re now officially represented (they’ll stop contacting you). Then we’ll work directly with your creditors to wipe out 20%-50% of your total unsecured debt, all at once.

Step 3

Get To Work

Become Debt-Free In Just 12-36 Months

Make ONE manageable monthly payment to demolish your debt in 36 months or less—while improving your credit score in the process! Throughout your journey, you’ll work with a dedicated account manager and get regular updates via email, phone, and text.

Why work with us?

Since our heavy-hitting attorneys have specialized in debt relief for decades, they likely already have solid relationships with your creditors. This puts us in a powerful position to negotiate with your creditors for maximum relief!

$2.1 Billion

Debt Resolved

97,000+

Clients

30+

$2.1 Billion

Debt Resolved

97,000+

Clients

30+

Years in business

Make ONE manageable monthly payment to demolish your debt in 36 months or less—while improving your credit score in the process!

Testimonials reflect the individuals' opinions and may not be illustrative of all individual experiences.

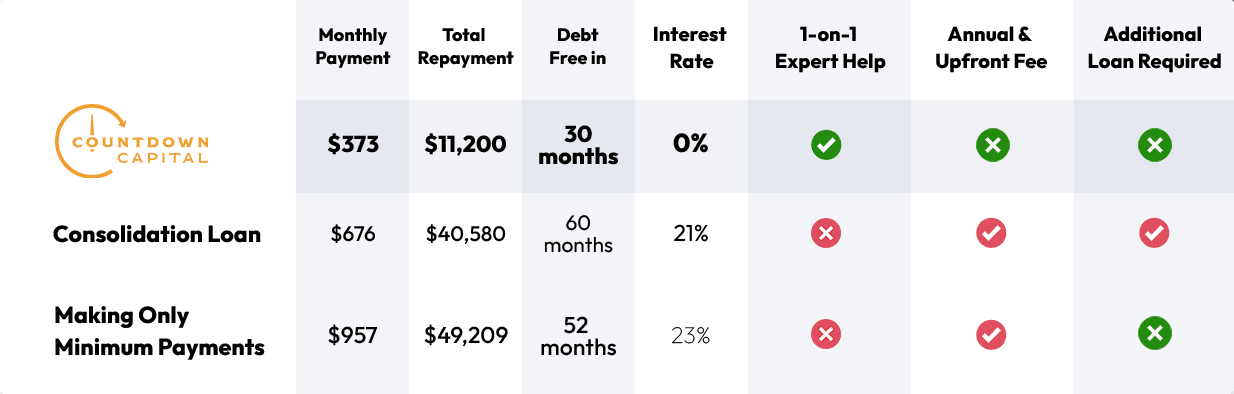

You Could Save Tens of Thousands!

If you had a total debt of…

$25,000

* The minimum payment example is based on a credit card for individuals with fair credit, having an interest rate of 23% (rounded up to the nearest percentage point) and assumes a payment of 3% of the balance. Please note that, assuming the principal balance does not increase due to additional charges, fees, and interest, the required minimum monthly payment will decrease over time as additional minimum monthly payments are made and reduce the total balance.

You Could Save Tens of Thousands!

If you had a total debt of...

$25,000

CUSTOM JAVASCRIPT / HTML

* The minimum payment example is based on a credit card for individuals with fair credit, having an interest rate of 23% (rounded up to the nearest percentage point) and assumes a payment of 3% of the balance. Please note that, assuming the principal balance does not increase due to additional charges, fees, and interest, the required minimum monthly payment will decrease over time as additional minimum monthly payments are made and reduce the total balance.

Frequently Asked Questions

CUSTOM JAVASCRIPT / HTML

Are You Ready To Reduce Your Debt ?

Connect with a specialist Today !

Copyright © Countdown Capital Inc. All rights reserved.

We provide debt resolution services. Our clients who make all monthly program payments save approximately 45 - 55% of their enrolled debt (average of 51%) upon successful program completion. Programs range from 20-48 months. On average, clients receive their first settlement within 4-7 months of enrollment and approximately every 3-6 months thereafter from when the prior debt was settled. Not all Clients complete the program. Estimates are based on prior results and may not match your results. We cannot guarantee that your debts will be resolved for a specific amount or percentage or within a specific timeframe. We do not assume your debts, make monthly payments to creditors or provide tax, bankruptcy, account2ing, legal advice or credit repair services. Our program is not available in all states; fees may vary by state. The use of debt resolution services will likely adversely affect your credit. You may be subject to collections or lawsuits by creditors or collectors. Your outstanding debt may increase from the accrual of fees and interest. Any amount of debt forgiven by your creditors may be subject to income tax. Read and understand all program materials prior to enrolling. Certain types of debts are not eligible for enrollment. Some creditors are not eligible for enrollment because they do not negotiate with debt relief companies. To determine the offers you may be eligible for, Countdown Capital conducts a “soft credit pull.” This credit pull does not impact your credit score, creditworthiness, or ability to obtain credit from other sources. The soft pull is not a tradeline entry, it does not report against your score and will only take a few minutes. Read and understand all program materials prior to enrolling. Certain types of debts are not eligible for enrollment. Some creditors are not eligible for enrollment because they do not negotiate with debt consolidation companies. We do not discriminate on the basis of race, color, religion, sex, marital status, national origin or ancestry.